Are you feeling financially overwhelmed? Do you worry that you may not have the money you need to take care of your monthly expenses?

If you are having these thoughts, you may want to consider refinancing.

Once you’ve decided whether or not refinancing is the right option for you, the process is relatively simple.

- First, you’ll research potential lenders and compare the benefits each one offers, including interest rates and other repayment terms.

- Then, after you’ve found a lender that will work with you on your specific needs, you’ll apply to determine your eligibility.

Regardless of the initial reason for your interest in refinancing your student loans, you’ve come to the right place to learn more about how the refinancing process could benefit you! There are many good reasons to consider refinancing. Still, it is important to ensure that refinancing your student loans will result in the relief you are seeking before you proceed.

Read “When to Refinance Student Loans” on debtfreeadventure.com to learn when to begin considering refinancing.

Establish Whether or Not Refinancing Is Right for Your Situation

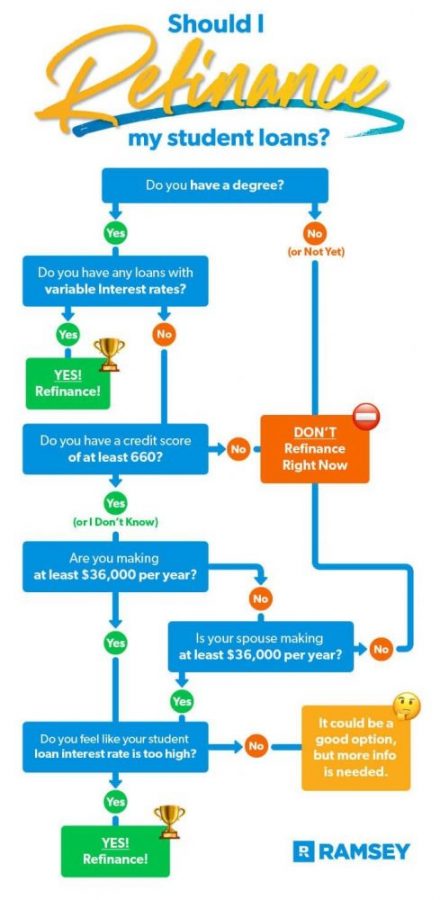

Deciding whether or not refinancing is right for you will be the most tedious part of this entire process. The answer depends on several factors.

To begin, let’s take a look at some popular reasons for choosing to refinance.

Reasons to Consider Refinancing Your Student Loans Now

- You can lock in a lower interest rate for your loan

- You can release an old cosigner from their responsibility for your loan

- You can reduce your monthly payments by refinancing

- You can find a more flexible repayment plan that fits your financial situation better

- You can consolidate multiple student loans to simplify your debt management

- You can find a lender that offers better service or benefits

Suppose any of the reasons listed above are relatable. In that case, the chances are good that you stand to benefit considerably from student loan consolidation.

There are, however, a few other aspects of your current situation to consider before diving into any applications.

Are Your Student Loans Federal Or Private?

For instance, whether your loans are Federal or private could make a difference.

For readers who have Federal student loans, this might not be the ideal time to refinance. With the current pandemic situation, Federal student loans are still on hold until October 1st, 2021. Read more here on the current issue at the federal level.

For many people, this has provided some much-needed temporary financial relief that would be hard to trump. If your loan terms are not amenable, however, it might be worth giving up that repayment grace period in exchange for more reasonable repayment terms in the future.

If you have private student loans, you likely already know that your payment schedule was unaffected by the pandemic.

However, APR rates for private loans are at a historically low level. Therefore, it would be a very smart move to refinance your private student loans now.

Check Your Credit Score Before Applying

One of the most critical factors affecting your eligibility for student loan refinancing is your credit score.

When you refinance your old student loans, the new lender will pay off all of your previous student debt. However, this refinance loan will be a completely new loan agreement with its’ own repayment terms, rates, etc.

For the lender to decide whether or not it is financially prudent to authorize your loan, they will assess your credit history, your debt to income ratio, and current financial income.

To qualify for the refinance loan, you must have a minimum credit score of 650. The higher your credit score, the better your chances of approval.

Research the Lender Options Available to You

If you aren’t sure what you’re looking for specifically, student loan lender paperwork can all look very similar. So, you should identify the specific goals you wish to address with your refinancing package before you proceed further.

Some lenders specialize in handling certain types of student loans that can offer you better services concerning specific loan types. Which of the following student loan refinancing options could be right for you?

- Credit union student loan refinancing

- Bank student loan refinancing

- Medical school student loan refinancing

- Teachers student loan refinancing

- MBA student loan refinancing

- International student loan refinancing

- Parent PLUS student loan refinancing

- Student loan refinancing with no degree

Once you’ve done some research and given some thought to this, you can properly identify lenders that will be willing/able to help you.

It is highly recommendable that you select several potential student loan refinancing lenders to compare amongst one another before making your final decision.

Compare Lender Estimates to Find the Best Price

Okay, so you have your list of possible lenders in hand. Now, you’ll need to do some deeper research into each option. This is to determine which has the best service options for your specific needs.

When you approach each lender for the first time, they will likely ask you to fill out some light paperwork and engage in what is known as prequalification.

This paperwork is standard for the industry and has no negative impact on your credit score, credit history, or overall financial health.

Your prequalification paperwork will gather some basic financial information and personal history. This information is collected to initially determine whether or not it will be possible for the lender to make you an offer.

Of course, the offer made based upon prequalification is not set until you have filled out a full application and received approval. Still, it is a good estimate to start with for comparison.

Negotiate Your New Loan Terms

After you have narrowed your choices down to one or two possible refinance lenders, you will negotiate terms with one or both.

- The first item you will negotiate will be the length of your repayment period. This will determine how quickly you finish paying off your refinanced student loan debt.

- The second item you will need to negotiate will be your interest rate. You can lock in either a variable rate or a fixed rate. If you choose a variable interest rate, your initial rate will likely be lower. However, it will be subject to change quarterly, monthly, or otherwise.

A fixed interest rate will begin at a higher rate than a variable rate. However, you won’t be subject to unexpected increases at any point during the loan repayment period. For many people, this security is worth the increased rate.

Submit a Full Application for Credit Approval

At this point, most of the work is behind you. However, you will need to gather important documents that pertain to your original loan, your financial history, and of course, your identity.

The full application for student loan refinancing is much more encompassing than the prequalification paperwork.

You will need to fill the application out carefully and double-check that all of the information you’ve provided is factually accurate and true to the best of your knowledge.

The lender will make copies of your essential documents and submit your application for a hard credit check at this point.

This final credit check for the application process will temporarily drop your credit score, as any hard credit inquiry does. The good news, however, is that you are now on your way to financial relief!

Wait for Notification That Your Old Loans Are Paid

If you are approved for your refinance loan, it may still take up to a couple of weeks for the new lender to fully resolve your old student loan accounts.

Therefore, make sure that you continue to make payments on your original student loans until the refinance agent has paid them in full. Otherwise, you run the risk of falling into default mid-consolidation.

Make Your Payments to the New Lender

If you’re keeping track of your old loans to stay current on payments, you’ll know when the new lender has closed out your old accounts. At this point, you’ll begin making your payments to the new consolidation lender.

Suppose you have any additional questions about what happens with your loan from here. In that case, your lender will be able to assist you going forward.

Leave a Reply