The capacity of a family to fulfill basic needs is a vital measure of its economic well being and stability. The family’s budget secures an acceptable living standard in their immediate community. Responsibilities become manifold when you become a parent.

As a parent, you need to set costs for many things. Some are easily anticipated while others are unforeseeable. You would be surprised by the things you need to spend the money on, regardless of how prepared you are.

Therefore, it is necessary to plan your monthly budget and also allocate a portion of the funds in an investment scheme. Everyone can play the stock market right from their phones but then there are even better options than that.

The Rise of Investment Apps

In this modern era, many things have changed. There are tons of investor-friendly apps and DIY models, which only need a bank account and the internet. After that, your own experience and learning can take you forward in investing.

In this modern era, many things have changed. There are tons of investor-friendly apps and DIY models, which only need a bank account and the internet. After that, your own experience and learning can take you forward in investing.

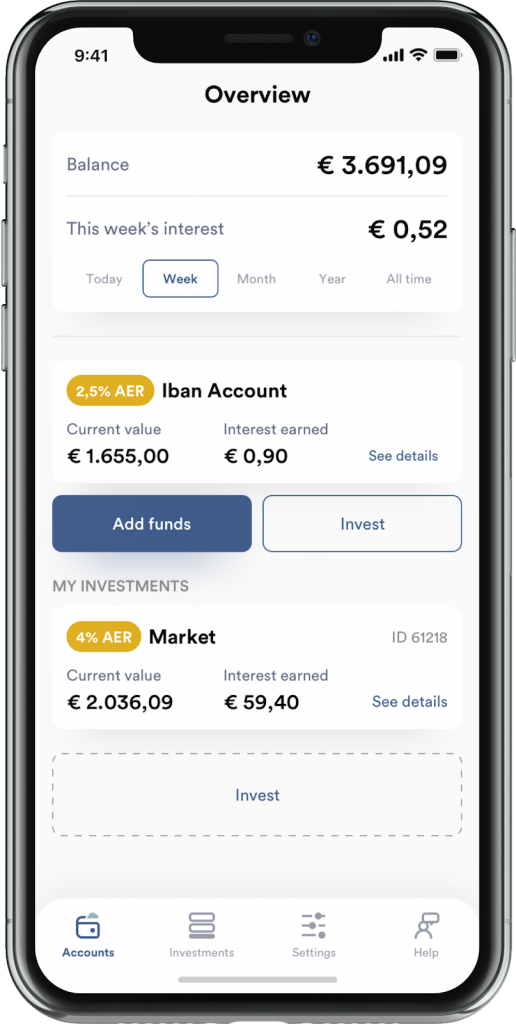

A subcategory of these investment apps are the spare change apps. These apps have an easy entry barrier (investment starts as low as €1). Different micro-investing apps have different features, but Iban Wallet clearly stands out with its free of account creation and withdrawal features. These low fees are good for beginners and families who have just entered into investing.

Benefits of Iban Wallet and Parents’ Connections

As a parent, the natural instinct is to pay it safe and this is what Iban Wallet exactly does. It helps you reserve an emergency fund of sorts. While you focus on different aspects of parenting, you can leave your money to grow at different projected fixed interest rates. Starting from a target rate of 2.5% up to 6%, the interest rate varies depending on the account type you choose.

It offers complete protection of your funds and does not have any serious restrictions. It can allow your savings to grow for a period of 1, 3 and 5 years and you can withdraw a sum amount this way. The earnings are directly and daily deposited into the account, as Iban Wallet does not involve any third party into its fold. Since the interest rate is fixed projected, it makes understanding of the funds comparatively easier. Otherwise, variable interests are much more difficult to understand.

For parents focused on savings only, Iban Wallet is just for them. The money can be withdrawn when needed and it promises conservative returns on your savings. As a digital platform, savings accounts do not really offer this one feature.

Final Verdict

Budget is a real lifesaver for parents, especially when children enter the picture. It is vital to follow the tips mentioned above to address any unforeseeable event.

Now that we have briefly covered the ins and outs of the Iban Wallet, it is safe to conclude that any parent can make use of this investment scheme/emergency fund when they truly need it. Interestingly, this investment scheme allows your money to grow for use when the time comes.

Leave a Reply