With summer looming ahead, many kids are requesting outdoor equipment that will keep them entertained while on a break from school. Hoverboards are a hot item, and many parents are concerned about the cost, safety, and which ones are going to be the most durable. Today, we explore four of the best hoverboards for kids. Note that all have been UL 2272 Certified for fire and electrical safety.

With summer looming ahead, many kids are requesting outdoor equipment that will keep them entertained while on a break from school. Hoverboards are a hot item, and many parents are concerned about the cost, safety, and which ones are going to be the most durable. Today, we explore four of the best hoverboards for kids. Note that all have been UL 2272 Certified for fire and electrical safety.

Owlet Smart Sock 2 Review: Is the Owlet Worth It?

Bringing home your baby from the hospital is a joyous occasion, but it’s also scary, especially for first-time parents. You may be even more scared if your child has health issues. For this reason, many parents turn to baby monitors for help. The Owlet Smart Sock 2 is the most unique type of baby monitor on the market. Created by Kurt Workman, Zack Bomsta, and Jordan Monroe, the Smart Sock is getting rave reviews after just a few years on the market. Is the Owlet worth it? Here’s what you should know.

Bringing home your baby from the hospital is a joyous occasion, but it’s also scary, especially for first-time parents. You may be even more scared if your child has health issues. For this reason, many parents turn to baby monitors for help. The Owlet Smart Sock 2 is the most unique type of baby monitor on the market. Created by Kurt Workman, Zack Bomsta, and Jordan Monroe, the Smart Sock is getting rave reviews after just a few years on the market. Is the Owlet worth it? Here’s what you should know.

My FreeCreditReport.com Review: How Does It Measure Up With Its Competitors?

The latest studies show that over $16 billion was stolen from consumers in 2016 thanks to identity theft. One way to monitor your personal information for signs of potential identity theft is to keep track of what’s on your credit report. A popular place for checking your report is FreeCreditReport.com, but is it secure and reliable? We’re going to find out in my FreeCreditReport.com review.

The latest studies show that over $16 billion was stolen from consumers in 2016 thanks to identity theft. One way to monitor your personal information for signs of potential identity theft is to keep track of what’s on your credit report. A popular place for checking your report is FreeCreditReport.com, but is it secure and reliable? We’re going to find out in my FreeCreditReport.com review.

My FreeCreditReport.com Review – Is It Reliable?

What Does Freecreditreport.Com Offer?

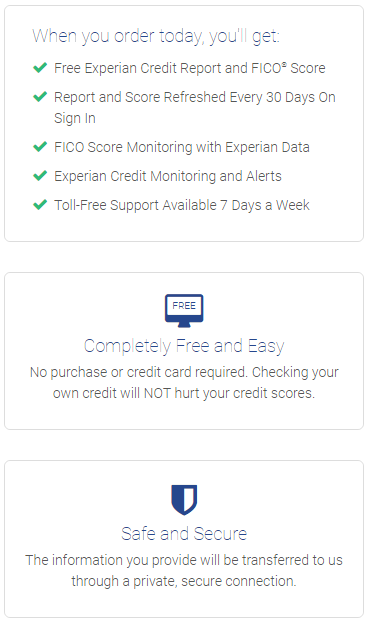

If you read the name, Free Credit Report sounds obvious, right? Although many of the older reviews I found included complaints that the services offered by Free Credit weren’t really free, the company has changed things up and now offers some items with no monetary obligation.

Here is what Free Credit Report offers with their no-cost plan.

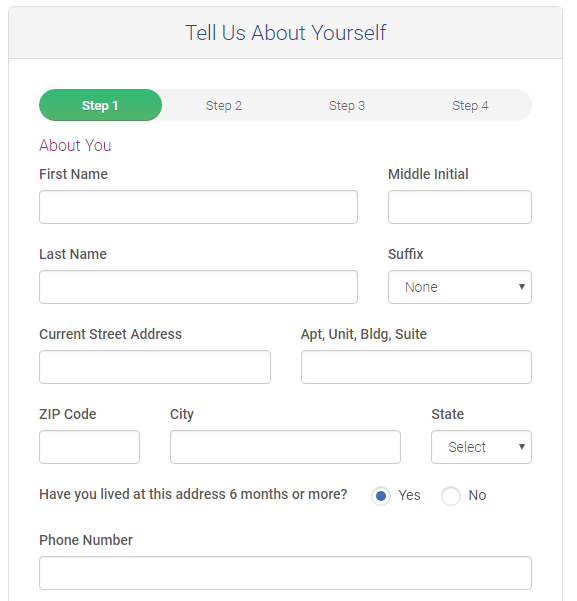

You can get your Experian credit score and credit report completely free of charge. The sign-up process with Free Credit Report is easy. First, fill in basic information such as your name and address.

After that, verify some personal credit or other information for security reasons. Questions may reference your mortgage lender or what your eye color says on your driver’s license.

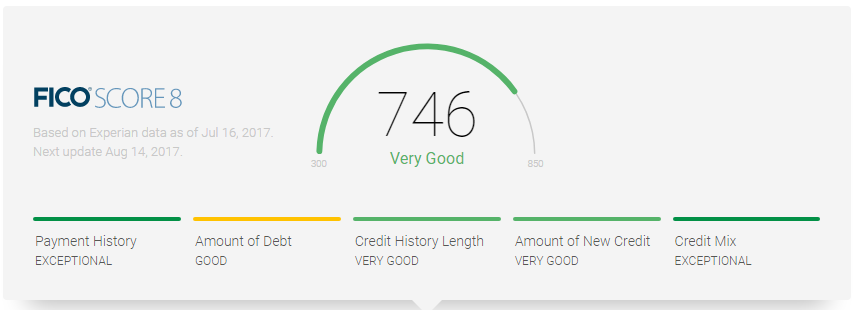

When you’ve answered all questions correctly, you’ll find your credit score.

Since Experian owns Free Credit Report, you’ll only get your Experian FICO, and not your TransUnion FICO scores.

Here are a few other things you’ll discover:

- Your current revolving debt balances

- How much available credit you’re currently using

- Your revolving credit limit

- Any recommended action steps like credit card balance transfers.

The site also shares how you compare to others in your area regarding your credit score and credit card balances. There are call-to-action boxes that offer Free Credit Report’s upgraded membership that will allow you to view all three credit reports (Experian and TransUnion) or sign up for advanced identity theft protection.

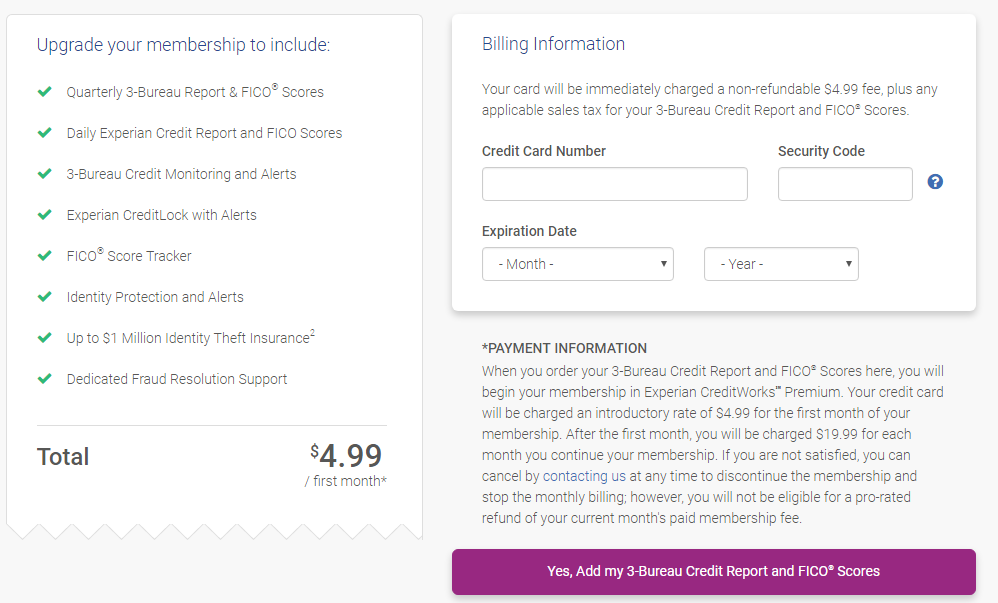

When you sign in to the site in any follow-up visits, the first landing page will be an offer to sign up for their upgraded plan. The plan says it is $4.99 for the first month, but after that, you will pay $19.99 per month for their upgraded plan.

Below is a “no” box that allows you to continue using their free plan, so there is no obligation to upgrade and you won’t be asked to enter a credit card number with the free plan.

Recommended Reading: “Facts About Loans Debt and How It Can Affect You”

How Does Free Credit Report Compare to Other Companies?

Other companies offer free credit reports too, but are they legit? Do they really give you your credit report for free? Here are some of the more well-known competitors of FreeCreditReport.com and what they offer.

Credit Sesame

Like Annual Credit Report, Credit Sesame offers you a picture of your financial situation for free. However, it is a compilation made from your credit reports and credit scores, and not your actual credit report or FICO score. Here is the statement from their website:

The annual free credit report that you get from the major credit bureaus is different from the free credit report card that Credit Sesame provides its users.

So while you will get a free picture of your creditworthiness from Credit Sesame, the reports and credit scores are different from what you’ll find on your actual Experian, and TransUnion credit reports.

Credit Karma

Credit Karma does give consumers free access to credit bureaus and their FICO scores as well, but only from TransUnion. They’ll also send you a notice if anything important changes on your credit bureau.

Based on the information listed in their reports they will recommend products and services to you, but your membership to Credit Karma is totally free.

In Conclusion

Free credit reporting companies are everywhere, it seems. Therefore, you should thoroughly research a company before signing up. Your goal is to avoid hidden fees and costs. FreeCreditReport.com is one company that delivers what it promises: your Experian credit report and credit score, free of charge.

Next Up: Loans for Stay-at-Home Moms: What Are Your Options?

How do you check your credit? Was this FreeCreditReport.com review helpful? Let us know in the comments!

You can also check out this great credit score tool online:

How to Afford Being a Stay-at-Home Mom

When I was pregnant with my first child, every day held excitement about the future. But I couldn’t quite shake the weight I felt on my shoulders when I thought about returning to work six weeks after her birth. I wanted so desperately to stay home, but simply couldn’t imagine how to afford being a stay-at-home mom.

When I was pregnant with my first child, every day held excitement about the future. But I couldn’t quite shake the weight I felt on my shoulders when I thought about returning to work six weeks after her birth. I wanted so desperately to stay home, but simply couldn’t imagine how to afford being a stay-at-home mom.

It just doesn’t come up much in school, does it? “Living On Half Your Income 101.” Yeah, not so much. Today’s culture often says things like “Put it on credit” or “You deserve more” or good ‘ole “YOLO.” But some dreams involve spending and earning a whole lot less.

And they sure are worth it.

See, my husband and I really needed a roadmap, some kind of guidelines to help us navigate these tumultuous waters.

If that’s you, then let me encourage you. Our “get-your-financial-act-together” journey started in 2011. In 2012, my husband and I paid off $22,000 to become debt-free right before our daughter’s birth. We stockpiled as much as we could into our emergency savings and learned to continually live within our means (MUCH harder than it sounds!).

This led to one of the happiest days of my life. It was in May of 2014. I was 30 weeks pregnant with our second child and kept having labor symptoms when I’d work on my feet all day at my job. Rather than risk a premature delivery, that became the catalyst for our leap of faith.

That was the day I quit my job and officially became a stay-at-home mom. I waddled to my car with astonishment stamped on my face. It really was happening.

You need to understand the primary reason for this astonishment. We would now be living on less than $2,000 a month. It seems impossible that we could have done this (especially if you knew how bad we were at budgeting when we were single!). The thing is, we hustled our hineys off and no longer had debt. We’d been budgeting like paupers and renting from family instead of rushing into a home we couldn’t afford.

Even on such a small income, we really were ready. Hence my amazement.

Every dream is different. And that’s OK.

Your dream may not be to stay home. That’s totally fine! If you love working outside the home, then embrace that and enjoy your work. Nor are you required to generate an income if you do decide to stay home full-time. Let’s just get that out there.

So many of the steps we took as a couple had very little to do with me making extra money from home. They set an important foundation that centered around three major components:

- Communication

- Changing habits

- Financial freedom

Let’s pull back the curtain a little further and explore what I mean.

How to Afford Being a Stay-at-Home Mom

Here are some practical first steps you can take in your journey toward spending more time with your kids!

Step #1: Kick debt to the curb.

When my husband and I committed to paying off our outstanding debt in two years instead of seven, we forced ourselves to:

- Budget every month

- Snip our credit cards and always pay with debit or cash

- Live intentionally on less

- Communicate in healthier ways about money

For example, the biggest way my husband and I melted debt was to intentionally begin living on his income. It took months, but eventually, we were able to apply every dime from my paycheck toward debt.

After that, our small income became that much more powerful. Imagine what you could do with your money if you didn’t have any payments. That one thought spurred us on.

Recommended Article: “10 Steps to Create a Successful Stay-at-Home Mom Budget”

Step #2: Save for the unexpected.

Saving for emergencies is the most powerful way you can create financial stability in your home. Smaller emergencies like an oil leak can be covered in the “auto repair” portion of your budget. But what if your income-generating spouse loses his job? That buffer is the difference between you remaining a stay-at-home mom through that transition or scrambling for work alongside your partner.

A great place to start with a savings buffer is $1,000. More can be accumulated once you’re out of debt, but that first $1k is your Kevlar vest against calamity.

Step #3: Act.

We covered the basics. Whether you’re a mother or would like to be one someday, you can begin this journey today. It’s time to choose your next step and ACT.

A great place to start is a conversation with your significant other. This plan requires openness and commitment from both of you. It’s also going to take time. Best to start the conversation now.

For example, when I messed up the budget, I knew I could approach my husband about it instead of burying my head in the sand like I’d done in the past. We worked through many problems that way. Extend grace. Talk about your dreams. Re-commit.

Another great next step is to further your education. Try joining a Facebook group that centers around whipping your family finances into shape. The added support is tremendous. Here are two great groups you can join:

Build on the foundation.

If you’ve read this far, it means you’re dead serious about your dream of becoming a stay-at-home mom. That’s awesome.

I believe you can do it, but this is just the framework. It’s not going to keep the rain or wind out of your house. To add siding, insulation, a roof, and even some shiplap if that’s your fancy, then I strongly encourage you to check out my eBook called “The Stay-at-Home Mom Blueprint.” In it, I expand my story on climbing out of debt and achieving my dream of staying home. I also walk you through 150 practical strategies that my husband and I used (and still use today) to communicate better, chop debt, and save money.

This is the roadmap I wish I’d had when we first dreamed of transitioning into a single-income family.

Also, if you do want to earn money from home, “The Stay-at-Home Mom Blueprint” includes dozens of ideas to sell your stuff, earn gift cards or cash from home, or build an online business. My business didn’t happen until nearly two years after I became a SAHM. Since then, I’ve made nearly $20,000 just working part-time as a freelance writer. I know without a doubt that this business wouldn’t have happened if I hadn’t safely transitioned into a stay-at-home mom first.

Ready to take your journey toward staying home to the next level?

Grab your copy of “The Stay-at-Home Mom Blueprint” today.

Your Turn: What advice would you give someone on how to afford being a stay-at-home mom? Share with us below!

This post may contain affiliate links.

Image Credit: AI Photography

Hungry for more financial tips for stay-at-home moms? Look no further!

How to Launch a 52-Week Money Challenge for Kids

As you set your goals each year, it’s fun to include your children in the process. Involvement helps them learn to set goals of their own. In the interest of helping them develop strong savings habits, why not have them participate in a 52-week money challenge for kids?

As you set your goals each year, it’s fun to include your children in the process. Involvement helps them learn to set goals of their own. In the interest of helping them develop strong savings habits, why not have them participate in a 52-week money challenge for kids?

Similar to the well-known 52-week money challenge for adults, the kids’ challenge helps kids to save more money by determining a set amount of cash to put into a savings account, and then increasing that amount each and every week.

How to Personalize Your Child’s 52-Week Money Challenge for Kids

Based on your child’s age and his or her ability to access money, you can pick the weekly money amount that works best for their particular situation.

Even with the smallest weekly contribution, the savings will add up. If your child is younger, you can start with a small amount – for example, a nickel – each week. Here’s how the challenge works:

- $0.05 contribution – WEEK 1

- $0.10 contribution – WEEK 2

- $0.15 contribution – WEEK 3

And so on. If you choose to use a nickel for the challenge, your child simply increases each weekly savings contribution by one nickel. By the end of the 52 weeks, your child will have saved $68.90.

Here is a breakdown of other coin values and potential savings amounts:

- Dime = Save $137.80 by the end of the 52 weeks.

- Quarter = Save $344.50 by the end of the 52 weeks.

- Dollar = Save $1,378 by the end of the 52 weeks.

Why Teaching Kids to Save is Important

We’re living in a time where it’s easy to not save money. Clever marketing and social pressures encourage kids to spend rather than save. Therefore, they start to believe they can have the latest and greatest of everything on the market – without the hard work of earning it.

Saving money is becoming less and less important to people as generations go by. America’s declining savings rate proves it. In May of 1975, the personal savings rate in the United States reached a high of 17%. At the end of 2016, it was 5.4%.

By teaching our children to develop a habit of saving money, we give them a head start on the road to financial responsibility.

Other Ways to Teach Kids to Save

Besides using a 52-week money challenge for kids, there are other ways you can teach your children to make saving money a consistent habit.

- Require your kids to save a percentage of all money they earn or receive as a gift

- Boost your child’s enthusiasm for saving by committing to match what they put into savings dollar for dollar

- Create a savings contest between you and your child (or between your children) to see who can save the biggest percentage of their income for the year

The 52-week money challenge for kids is a great way to encourage children not just to save money, but to challenge themselves to save more than they initially thought was possible. So, give your kids the gift of making savings a habit starting today.

Bonus Reading: “6 Fun Money Games for Kids”

Would you ever do a 52-week money challenge with your child? Have ever done one on your own? Let us know in the comments below!

Image Credit: Nathaniel_U (Creative Commons)

Are you a stay-at-home mom? Make sure you bookmark or pin some of these resources for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

- 52-week Money Challenge by Saving Advice

Here are 8 of the Best Kids Books On Audible

We all know reading to a child is paramount to his or her development. In my experience as a mother of two, I’m always on the hunt for fun, new ways to teach my kids. One of our favorite ways is listening to audiobooks. Therefore, I put together my top 10 list of the best kids books on Audible.

We all know reading to a child is paramount to his or her development. In my experience as a mother of two, I’m always on the hunt for fun, new ways to teach my kids. One of our favorite ways is listening to audiobooks. Therefore, I put together my top 10 list of the best kids books on Audible.

There are several benefits from audiobooks that I would like to share with you.

Kids learn to sit still. A byproduct of your children sitting in one place and paying attention to the narration of a book is that they’ll develop a stronger habit of sitting still. Even my two-year-old has shown improvement in his ability to sit quietly when the need arises. This comes in handy when you’re in a public place such as a waiting room or classroom.

Also, audiobooks expand a child’s vocabulary. Children are often introduced to new words in context and with their pronunciation. Often these books promote education, behavior, language, mathematics, etc. It also gives your child a fresh form of media besides a screen.

While reading to your child at bedtime is a vital bonding experience, audio books for kids create another dimension of imagination and education without the addictive side effects of screen time.

Let’s take a look at some great audio books my kids enjoyed over the last few years.

8 Memorable Audio Books for Kids of All Ages

EARLY LEARNERS – 0 to 5 years

1. “The Little Engine That Could” by Watty Piper

Despite its small size, the little engine used the power of positive thinking to conquer a mountain. This lesson is great for every generation of kids and can be enjoyed on audio with the rich tones of Mike Ferreri narrating.

2. “The Peter Rabbit Collection” by Beatrix Potter

This beloved classic exposes your children to the adventures of Peter Rabbit and his woodland friends. On Audible.com, you can now enjoy the entire Peter Rabbit collection for a very low price.

3. “The Cat and the Hat and Other Dr. Seuss Favorites” by Dr. Seuss

What was your favorite Dr. Seuss book as a child? Well, now it might be available on Audible for your whole family to listen. These best-sellers have stood the test of time for six decades.

Not to mention, this collection of audible stories is narrated by:

- Kelsey Grammar

- John Cleese

- Dustin Hoffman

- Billy Crystal

- And More…

GRADE-SCHOOLERS – 6 to 11 years

4. “The Wizard of Oz” by Frank L. Baum

This classic story is so enjoyable to listen to, due to the dynamic narration performed by award-winning actress, Anne Hathaway. She brings an “all-in” devotion to each character that will capture your kids’ attention (and yours, too!).

5. “Harry Potter and the Sorcerer’s Stone” by J.K. Rowling

Why am I putting one of the most popular children’s books on this list? Two words: Jim Dale. Never have you heard an audiobook until you’ve been read to by award-winning voice talent, Jim Dale. Even as an adult, I get a kick out of J.K. Rowling’s great storytelling and Dale’s diverse collection of voices for the memorable characters in Harry’s world.

If you believe your child is old enough for the thematic elements of this book, then give the audiobook a shot.

6. “The Kid Who Only Hit Homers” by Matt Christopher

Do you have a ball player in your family? I don’t know of anyone who wrote better sports books for middle readers than Matt Christopher. I’d finish a story, and feel a strong impulse to grab a ball and glove and speed off to the park.

One of Christopher’s most popular stories, “The Kid Who Only Hit Homers,” is available on audio with a full cast of narrators.

7. “The Hobbit” by J.R.R. Tolkien

This dramatized audiobook is the narrated telling of Tolkien’s bedtime story about the adventures of Bilbo Baggins. Follow his journey with a whole slew of dwarves as they head toward the Misty Mountain in search of their long-lost treasure – guarded, of course, by a fire-breathing dragon.

8. “Hidden Figures” by Margot Lee Shetterly

This is the true story of the African-American women who helped the United States win the space race. Shetterly’s book became a movie in 2016 and sends an important message to young people that their minds are precious, no matter their color or gender.

Reading is a delight that can last a lifetime. Help your child understand the many layers of literature and the skills he or she will need to get lost in a story and enjoy the endless worlds waiting on the pages.

Bonus Reading: “Dolly Parton’s Imagination Library Wants to Give Your Child a Free Book Every Month”

Got your own list of best kids books on Audible? We’d love to hear it!

If you’re a stay-at-home mom, make sure you bookmark or pin some of these great resources for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

4 Creative Money Challenges for Kids

One of the biggest – and most important – hurdles parents face is that of teaching their kids to save money. In today’s instant gratification world, kids are often led to believe that spending is more beneficial than saving. It’s our job as parents and caregivers to teach them the benefits of saving over spending. By utilizing these money challenges for kids you can help your child learn the importance of saving money.

One of the biggest – and most important – hurdles parents face is that of teaching their kids to save money. In today’s instant gratification world, kids are often led to believe that spending is more beneficial than saving. It’s our job as parents and caregivers to teach them the benefits of saving over spending. By utilizing these money challenges for kids you can help your child learn the importance of saving money.

4 Creative Money Challenges for Kids

The 365-Day Money Challenge

The 365-Day Money Challenge has flexibility in both the amount of money you can use and when you earn it. The first step is to print out a chart that has 365 days of money amounts on it, starting with $.01 up to $3.65. Then, post the chart somewhere where your child will see it every day. Each morning when your child gets up, they pay their piggy bank or money jar an amount from the chart. When they pick a money amount to save, they then cross that amount off on the chart. Each money amount can only be used once throughout the year. By the end of the year, they’ll have saved $667.95!

Wants some ideas for how to help your child earn money? Check out these chores here.

The Matching Money Challenge

This money challenge will involve parents and/or grandparents as well. The first step is to have your child decorate a jar with a lid, such as a large canning jar. They can also use their own piggy bank. Each week your child will put in their bank the money they’ve earned through different sources. Money earned for chores or allowance, or money received from gifts are some ideas for finding money to save.

After the jar is filled up, parent and child bring the jar to the bank to deposit the money. When the money is counted, parents or grandparents match the amount the child has saved. The final deposit into your child’s savings account will be double what they have saved!

The 52-Week Savings Challenge

Similar to the 365-day challenge, this challenge requires kids to save money on a regular basis. First, they print out this chart. Each week has a money amount – payable in quarters – listed on the chart. Your child chooses which amount he or she wants to save each week, crossing that amount off as they go. By the end of the year, your child will have saved $344.50.

The Make-it-Your-Own Money Challenge

This challenge can be implemented in a number of different ways. The goal is to help kids improve their lives in some way or teach them that work produces income. The first step in this challenge is to determine a dollar amount payout. Parents can work with children to help decide how much they want to earn in a given time period. The challenge can be modified to work for every family’s budget and specific goals.

For instance, some kids may have a goal of earning $10 in a week. Others might want to earn more over a longer time period. It also helps to determine with your child why he or she wants to save. Having a reason for saving helps motivate kids to save more.

After you’ve determined how much to save and in what time period, parents create jobs or tasks with coordinating payouts. The “jobs” can consist of several different options, such as:

- Doing chores around the house that are outside of normally assigned chores

- Doing learning challenges such as reading books or completing math worksheets

- Implementing healthy habits such as exercising or making healthy eating choices

- Choosing to cut down on screen time in favor of reading or spending time with loved ones

The challenge can be customized to fit whatever goals your family or your child may have. As a bonus, your child will earn a reward them for achieving those goals.

Teaching kids to manage money well is just one of the things we can do to prepare them for independence. By helping our children develop a habit of saving money, we can prepare them to be financially responsible adults.

Got any money challenges for kids of your own to add? Drop it below!

Are you a stay-at-home mom? Check out these hot tips and pin one for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

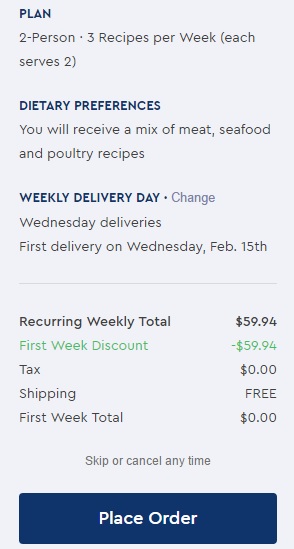

Blue Apron Review: Is This Meal Delivery Service Right for Your Family?

Blue Apron’s meal delivery service was just the reboot my family needed to try fresh meals and food combinations we’d never experienced. As a mom, meal planning is a huge part of my week. Sometimes, I get stuck on autopilot with family favorites like pizza, tacos, or breakfast for dinner. Or peanut butter and jelly. We all know how much time and effort it takes to cook a new meal from scratch. So, here is a Blue Apron review.

And, we all know how much free time parents have…

What if someone just handed you a box of ingredients and a recipe so you could finally try out some new, healthy meals?

(That’s your cue, Blue Apron.)

Want to know what goes into cooking a Blue Apron meal? Check out these real families trying it out for the first time in this video.

[youtube https://www.youtube.com/watch?v=kdvnpdJ7RtE]

My Blue Apron Review: Is It Right for Your Family?

Trying Out Blue Apron

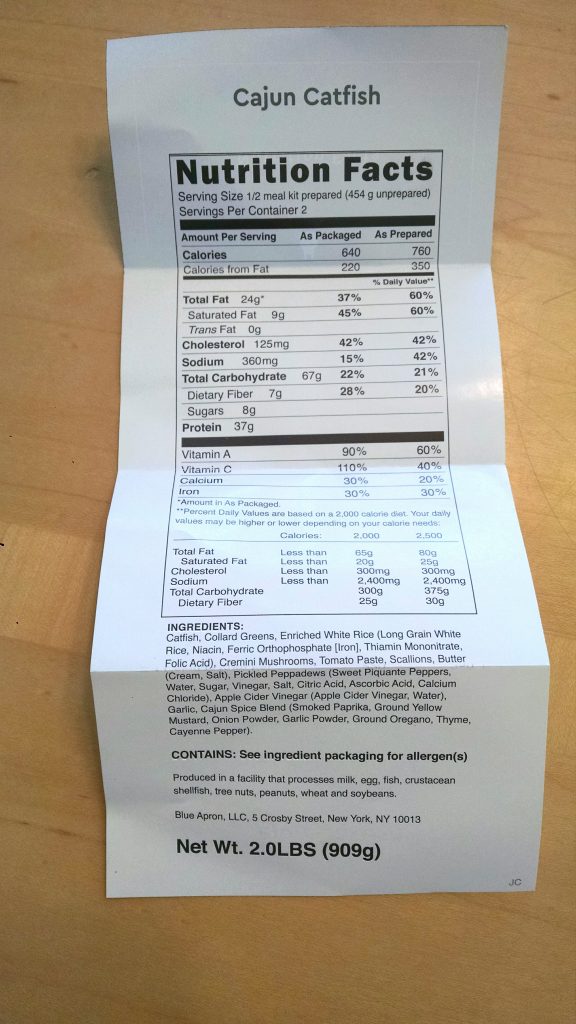

Blue Apron’s user-friendly website made it very easy to get started. I noticed there were options for specifying dietary preferences or restrictions. They assigned three meals to me:

- Cheddar Cheeseburgers

- Spicy Chicken Chili

- Cajun Catfish

I’ll be honest. My first reaction was a furrowed brow. I’m not a huge spice fan, nor do I care much for cheeseburgers. (I’m so glad I didn’t have a choice with the meal selections, though. Keep reading to find out why!)

A box showed up on my doorstep a week later. My kids could barely contain their excitement. I was psyched, too.

Upon opening the box, we discovered colors and shapes and textures all waiting to be diced, sauteed, and garnished. It was delightful.

I loved the freshness of it all. It truly was a chance to cook gourmet meals from scratch as a family.

I loved the freshness of it all. It truly was a chance to cook gourmet meals from scratch as a family.

Each meal comes with clear instructions. The kids loved looking at the step-by-step pictures and matching the foods with them.

Benefits and Drawbacks of Blue Apron

With any review comes the honest observations of pros and cons. I feel it’s only right to share both sides of my experience with you.

BENEFITS

Blue Apron completely transformed my kitchen. The aroma of Cajun rice with red peppers cooking next to two catfish fillets with sauteed collard greens was a thrill for my senses. Also, the food was delicious. I’m so glad I didn’t get to decide what meals arrived because I would never have braved these new flavors. They weren’t kidding when they said food from scratch is best!

Blue Apron also gave me the gift of education. I was able to teach my children about the meals, the seasonings, the nutrition in each food, and so on. My daughter bragged to her friends, dolls, and everyone in earshot that she tried a radish for the first time (Blue Apron sent a recipe for a kale and radish salad). I love that my kid took pride in eating healthy food.

Blue Apron also gave me the gift of education. I was able to teach my children about the meals, the seasonings, the nutrition in each food, and so on. My daughter bragged to her friends, dolls, and everyone in earshot that she tried a radish for the first time (Blue Apron sent a recipe for a kale and radish salad). I love that my kid took pride in eating healthy food.

Note: My kids are too young for using a knife, but if you have older kids, this is a great opportunity to teach them some important food prep/kitchen safety skills they can carry into their own lives down the road.

DRAWBACKS

Every recipe had something spicy which didn’t work so well for my 2-year-old. If you have younger kids, you may need to keep leftovers handy or whip up something on the side. That did take more time and effort.

Also, the prep time before meals is fairly time-consuming. That makes sense with meals from scratch, but the estimated prep time on each recipe card was much shorter than what it took me to wash, dry, mince, and chop everything. With both kids hovering nearby and no sous-chef, it simply took extra time. Make sure you factor that in when you plan your evening so that you’re not serving dinner at 8:30 PM (that may or may not have happened on Day 1…).

The most obvious potential drawback is the expense. Family meals per week are between $70 and $140. That’s a significant investment many can’t afford to make. The health benefits could, however, be worth it in the long-term.

Blue Apron Review: My Conclusion

Blue Apron has become my unofficial culinary school. Since trying it, I’ve branched out and purchased new ingredients at the store like fresh salmon and, yes, catfish fillets.

Blue Apron has become my unofficial culinary school. Since trying it, I’ve branched out and purchased new ingredients at the store like fresh salmon and, yes, catfish fillets.

Although my husband and I agree that Blue Apron isn’t something we can afford continually, I’d love to try it out with the kids when they’re a little older. What a great way to make some memories, learn an awesome skill, and eat healthier.

If you don’t think this is a good fit for your family, consider it for when the kids get older or give it as a housewarming or wedding gift.

Ready to give Blue Apron a try? Click here to get started. That link is also good for $30 dollars off your first order.

Full disclosure: I obtained three free meals for the purpose of reviewing Blue Apron. However, the opinions and thoughts shared below are entirely my own.

If you enjoyed this article please leave us a comment below or share it on social media.

Here are Blue Apron reviews from our friends, Budget and invest, Thousandaire and Cleverdude. And for a more holistic view on all the current meal kit vendors, be sure sure to check out top10.com!”

P.S. Are you a stay-at-home mom? Make sure you bookmark or pin some of these resources for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

My Paribus Review: Is Paribus Receipt Fetcher the Next Money-Maker for Your Family?

According to a Pew Research Center survey, 79 percent of Americans made online purchases in 2016. Fifty-one percent purchased something on their cell phones. Parents make up a massive percentage of those shoppers, so that’s why I’ve put together this Paribus review. It’s here to help you find ways to earn cash back on those online purchases this year.

According to a Pew Research Center survey, 79 percent of Americans made online purchases in 2016. Fifty-one percent purchased something on their cell phones. Parents make up a massive percentage of those shoppers, so that’s why I’ve put together this Paribus review. It’s here to help you find ways to earn cash back on those online purchases this year.

My Paribus Review: Is Paribus Right for Your Family?

If you’re handy with your smartphone, you probably already use money-saving apps like RetailMeNot, Swagbucks, or Walmart’s Savings Catcher, but there’s a new kid in town called Paribus, and it’s different than any other app you’ve tried.

What Is Paribus?

Paribus is an app available to all Apple devices and is free to download. Every time you shop online, Paribus automatically scans your digital receipt to see if there are purchases eligible for cash back over the subsequent weeks.

For example, let’s say you bought your son a $60 LEGO kit at Walmart.com for his birthday last week, but you’ve just noticed the price dropped to $40! Paribus automatically contacts Walmart to find out if you can get that $20 refunded. If they agree, then you get 100% of that refund!

Not bad for doing basically nothing, right?

What Are the Benefits and Drawbacks to Using Paribus?

It goes with the territory that every new product has its pros and cons. Your days are filled with tending to kids, running your household, and keeping your head on straight. My job is to help you make an informed decision about products that may or may not benefit your family as honestly as I can.

Therefore, here are the benefits and drawbacks I observed when using Paribus.

BENEFITS

It’s free. From the moment you download the app to your first cash back alert, there are no charges or hidden fees. Although, you do have to spend money shopping online, obviously!

It could be great for the holidays. Last Christmas, I asked a group of moms to share their favorite way to go Christmas shopping and the majority answered, “Online.” If you rack up most of your holiday spending money with online retailers then you could be in for some cash back on some of those purchases.

DRAWBACKS

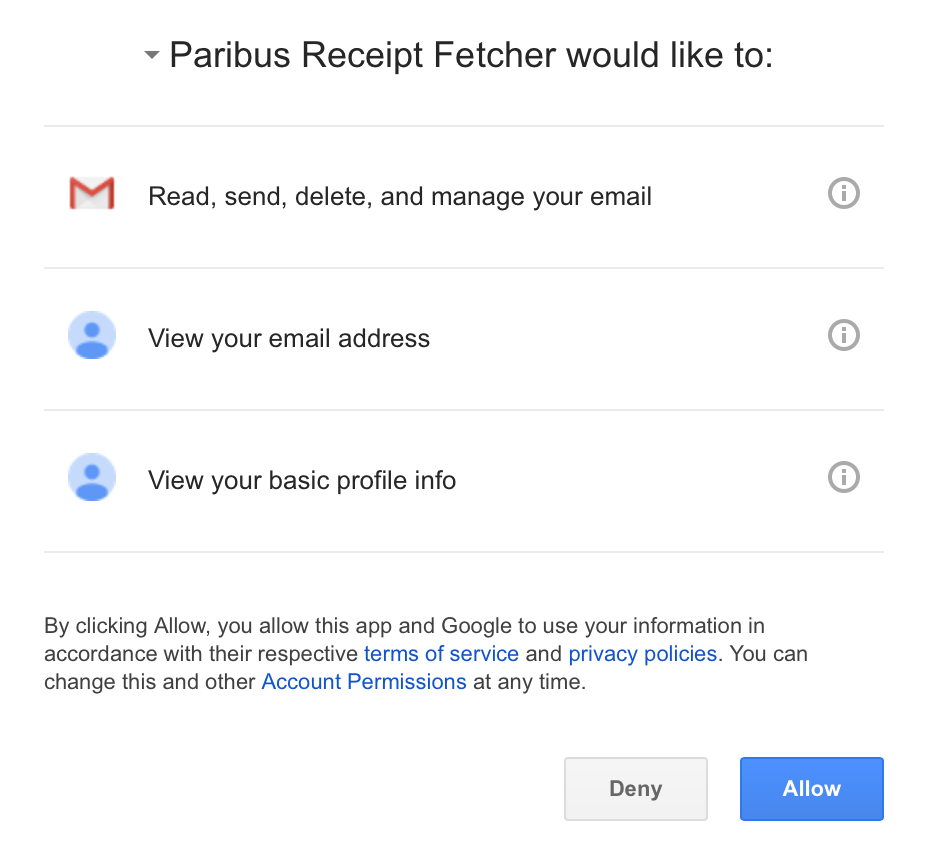

You have to share quite a bit of private information with Paribus. Like I said earlier, I want to be totally honest in this review, so I need to share one drawback that gave me considerate pause at first. Paribus will have authority to read, send, delete, and manage your email. They also request your Amazon login and password, as well as your credit card information.

I worked for years in fraud prevention at a financial institution, so those were automatic red flags to me. I dug in and researched user experiences since the app’s inception in 2014. Despite the scary amount of personal information, I did not read one report of fraudulent activity or compromised information from users.

I’m just reviewing this product as a consumer and don’t have authority to ensure this software is secure, but you can hear directly from Paribus and learn more details about how they handle our information via this CNBC report.

Watch out for hiccups. I experienced a technical bug when I tried to sync my Amazon account with Paribus. Upon further research, I discovered several other complaints about technical hiccups like that. I’m sure they’re updating and ironing out bumps all the time, but just be aware that those may cause some delays.

Not every purchase or store is eligible. A number of users complained that Paribus only pays back on eligible stores and purchases, so their cash back wasn’t as much as they hoped. Considering your family’s needs over the course of this year, you may want to evaluate where you’ll be shopping for them and how often. Paribus updates the list of eligible retailers regularly.

Paribus Review – Final Thoughts

The million dollar question is this: Did I actually get cash back using Paribus?

Not yet. I believe the reason is because I shop infrequently online and have only just started using Paribus.

Paribus is a free app that requires minimal upkeep, so if your alright with the parameters discussed throughout this article and you already shop online regularly, then it’s likely this app will make you some money. If you don’t shop a lot until Christmas, then it may still be helpful. If you just don’t shop a lot, ever, then you may not hear much chatter from Paribus.

Are money-saving apps like Paribus a wise replacement for good financial habits? Not at all. We use terms like “personal finance” and “financial living” because you must live out certain principles in order to succeed. Laying a foundation with things like budgeting, saving, and spending less than you make are far and away more important than using the right gadget or app. Are apps still helpful? Yes. But don’t let them tempt you to spend more than you intended to and wreck your foundation.

The Sign-Up Process

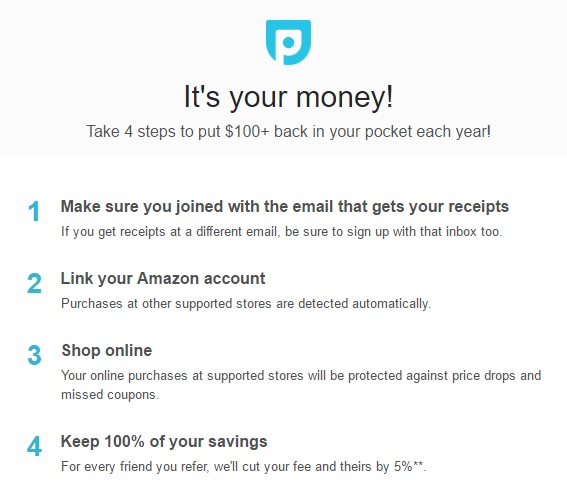

The following four steps taken directly from Paribus’ sign-up page will help you get started:

In other words:

- Download the app.

- Sync your info to Paribus.

- Shop.

- Get paid.

Where are some of your favorite online stores when you’re shopping for your family? Share one below!

This post was sponsored by Paribus.

P.S. Are you a stay-at-home mom? Make sure you bookmark or pin some of these resources for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

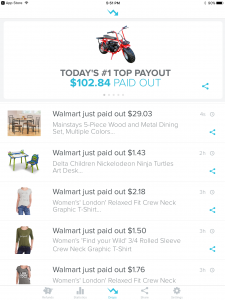

How Does Giving Assistant Work?

I think we can all agree that shopping online is the bees’ knees, right? Not only are online prices super competitive, the “work” of shopping can often be done faster from home. And bonus; the items you buy are delivered right to your front door. As an added benefit, companies like Giving Assistant are actually paying customers to shop online.

I think we can all agree that shopping online is the bees’ knees, right? Not only are online prices super competitive, the “work” of shopping can often be done faster from home. And bonus; the items you buy are delivered right to your front door. As an added benefit, companies like Giving Assistant are actually paying customers to shop online.

That’s right. They give you cash back on the things you buy.

How Giving Assistant Works

The first step is to create a free account with Giving Assistant.

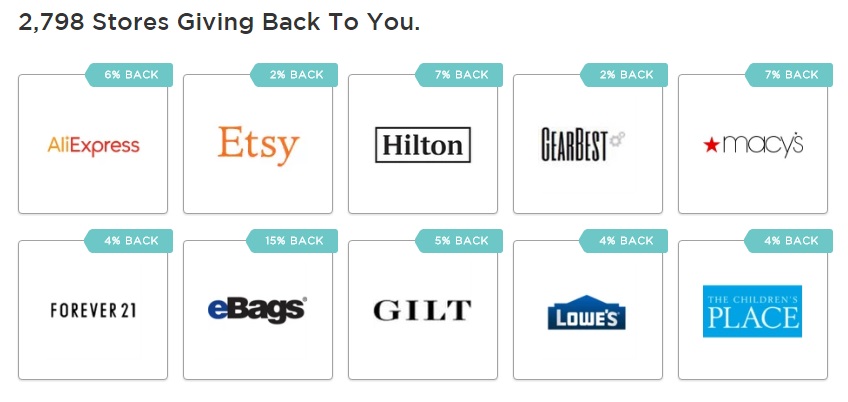

After you log in to your account, you can start shopping either by store or by category. Each store offers a certain percentage of cash back on purchases. Five percent is the average discount percentage. However, many stores offer discounts of up to 7% and even more, depending on the day.

When you make a purchase, the store pays that cash back to Giving Assistant. If you’re a member, the cash back goes right into your account.

If you’re a non-member, Giving Assistant keeps the cash back and donates a meal to Feeding America. In fact, Giving Assistant donates a meal to Feeding America for every single qualified purchase.

As a bonus, Giving Assistant informs buyers of any online coupons that can help bring their purchase price even lower. When you combine coupons with cash back bonuses you save even more money on the things you buy.

How to Receive Your Cash Back Bonuses

As you accumulate cash back rewards, the site allows you to transfer those rewards to a debit card through Paypal. You’ll have the option to transfer your money once you’ve earned at least $5.01 in bonus cash. No waiting for checks to come in the mail or trying to reach high minimum payout balances.

Giving Assistant pays out pretty quickly as well – often within one business day when using Paypal’s secure site.

Giving to Charity through Giving Assistant

When members earn cash back, they also have the option of donating some or all of their earnings to charity. Members can choose from hundreds of non-profit organizations to donate to, such as Feed the Children or the Red Cross.

Which Stores Participate?

According to their website, Giving Assistant has over 2700 stores participating in its cash back program. Some examples are:

- Big box stores such as Walmart, Target, Kmart and Kohls

- Online retailers such as Amazon and Coburn’s

- Specialty sites such as Etsy, Redbubble, Café Press and Ebay

- Specialty stores such as Macy’s, Nordstrom, Coach and Ann Taylor

With nearly 3,000 stores to choose from, everyone is bound to find a shopping venue that fits their needs.

In this day and age, people are becoming more mindful of how their purchases affect the world as a whole. With Giving Assistant, shoppers can become a part of a growing conscious capitalism movement.

By combining shopping with charity, you meet your needs and help the less fortunate get their needs met, too. Shopping responsibly has arrived.

Are you a fan of shopping online? Would you ever try Giving Assistant? Share why or why not below!

ATTN Stay-At-Home Moms: Make sure you bookmark or pin some of these resources for later!

- 10 Steps to a Successful Stay-at-Home Mom Budget

- How to Afford Your Dream of Becoming a Stay-at-Home Mom

- 14 Online Jobs for Stay-at-Home Moms (That Are Worth Your Time)

- 13 Ways for Stay-at-Home Moms to Save Money

- Loans for Stay-at-Home Moms – What Are YOUR Options?

- The SAHM Budget Test: How to Afford to Be a Stay-at-Home Mom

- Walmart Savings Catcher

- How Much Do Youtubers Make?